Sharecare announces second quarter 2023 financial results and operational highlights

ATLANTA – August 9, 2023 – Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced financial results for the quarter ended June 30, 2023.

“Our integrated approach to delivering comprehensive care solutions has proven successful in enhancing user experiences, reducing costs, and measurably improving clinical outcomes across populations, whether people are managing high-risk and chronic conditions or simply require routine preventive care,” said Jeff Arnold, chairman and CEO of Sharecare. “With our continued investments in generative AI, advocacy, and home care, we have the ability not only to generate personalized health insights derived from individual and aggregated data and deliver more tailored and engaging care solutions to people, but also to quickly identify health risks within diverse customer populations and close care gaps at scale, which is a win-win for our customers and their members.”

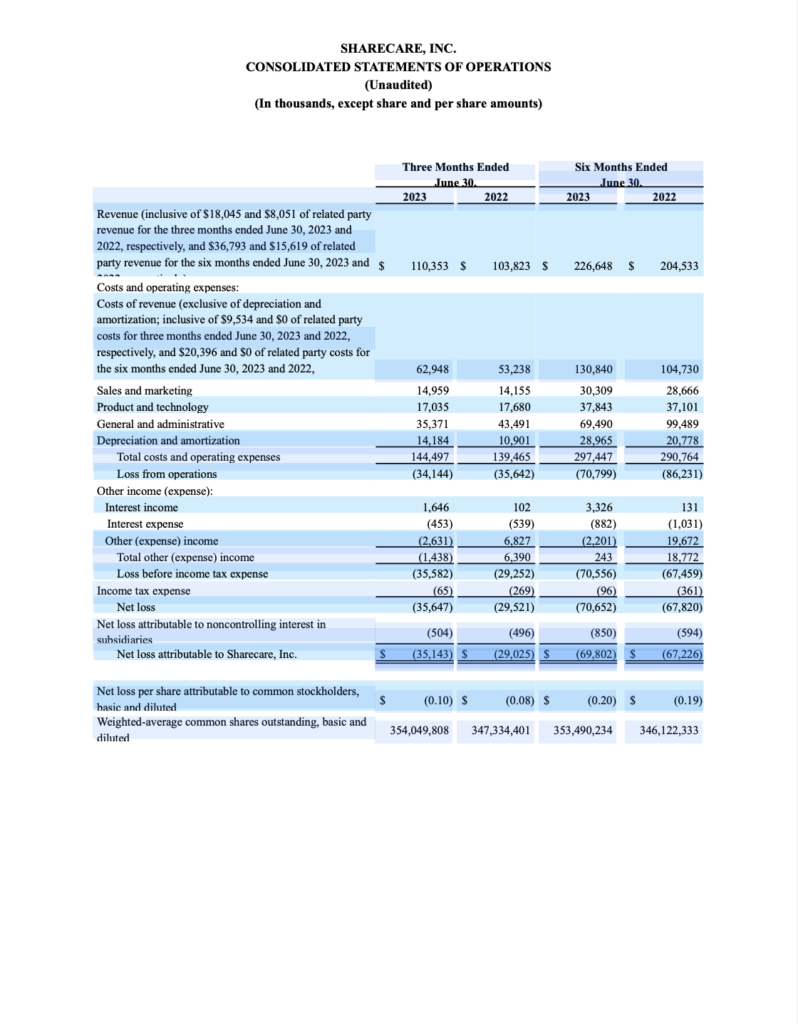

Second Quarter 2023 Financial Results

All comparisons, unless otherwise noted, are to the three months ended June 30, 2022.

- Revenue of $110.4 million compared to $103.8 million, an increase of $6.6 million, or 6.3%.

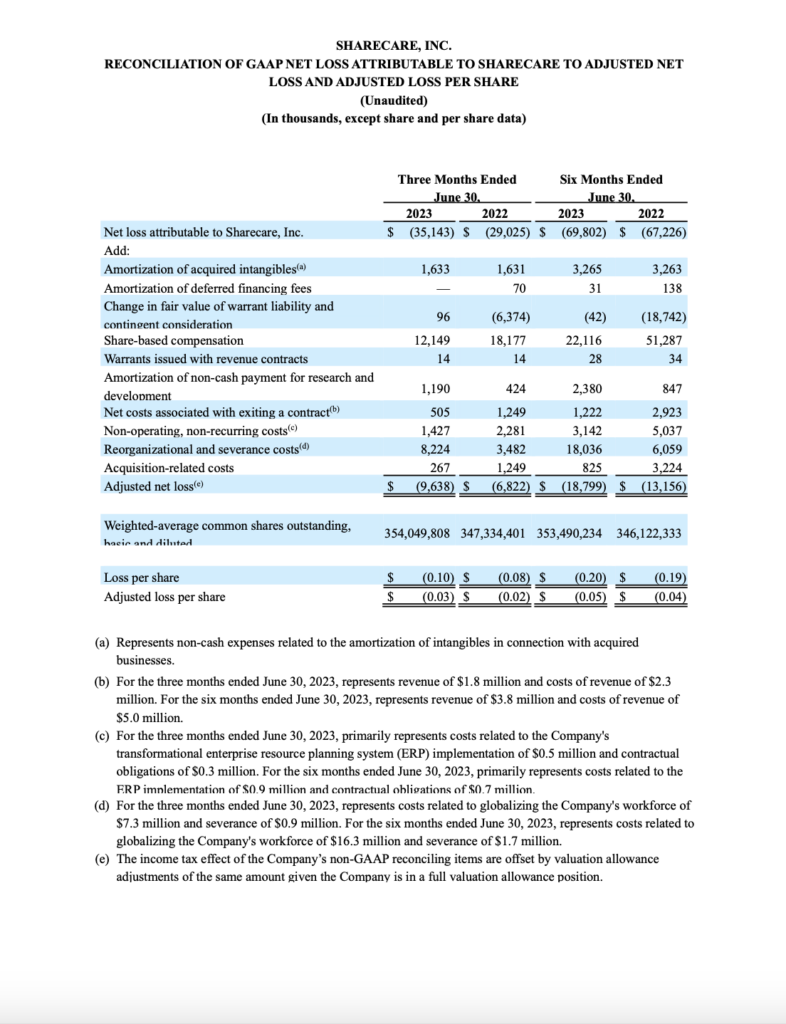

- Net loss attributable to Sharecare of $35.1 million compared to $29.0 million, an increase to net loss attributable to Sharecare of $6.1 million. Net loss attributable to Sharecare in the second quarter of 2023 included $12.1 million in non-cash stock compensation; $1.4 million in non-operating, non-recurring costs; $8.2 million of reorganizational and severance costs; and $3.8 million of other non-cash or non-operational expense. Excluding these amounts, the adjusted net loss was $9.6 million in the current quarter.

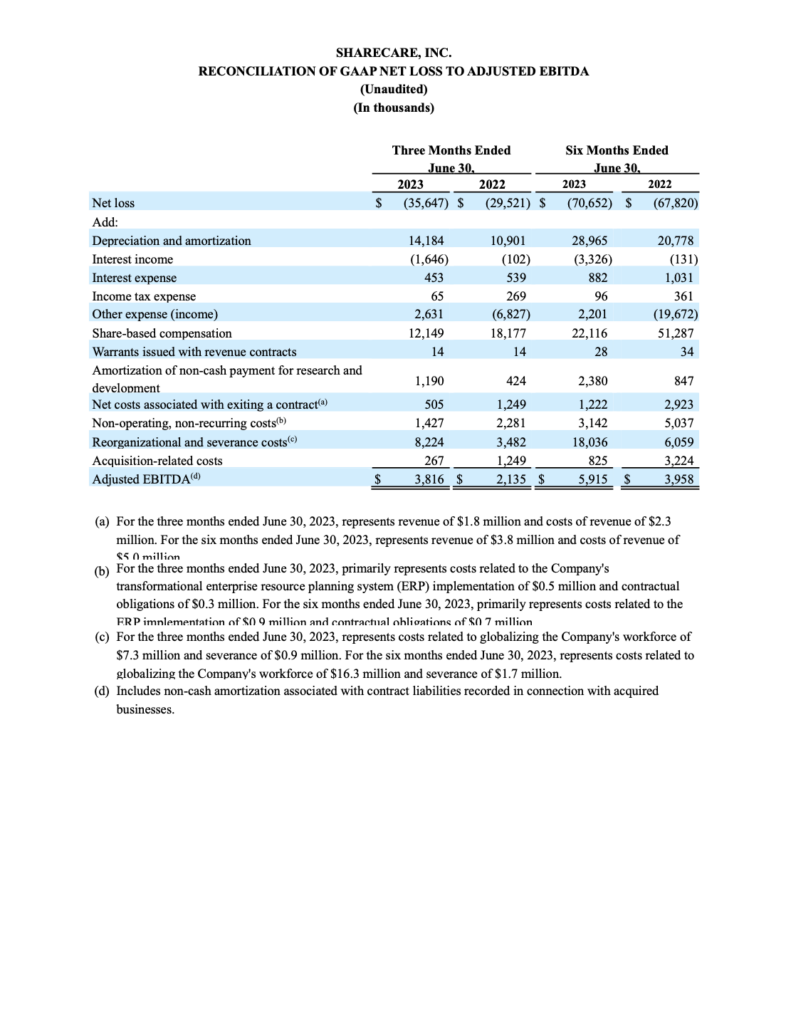

- Adjusted EBITDA of $3.8 million compared to $2.1 million, an increase to adjusted EBITDA of $1.7 million.

- Net loss per share of $0.10 compared to $0.08, an increase to net loss per share of $0.02.

- Adjusted net loss per share, which excludes the impact of non-cash and non-operational amounts, was $0.03 compared to $0.02, an increase to adjusted net loss per share of $0.01.

Arnold added, “With the conclusion of our strategic review, which we announced in the quarter, the Board came to the unanimous decision that our three business channels – Enterprise, Provider, and Life Sciences – complement one another with a depth and breadth of capabilities that, together, create a unique platform-driven ecosystem built for scale. We are confident that the strategic alignment of these businesses allows us to seize new growth opportunities and serve our expanding customer base and their needs more effectively today and into the future, and we remain committed to maximizing shareholder value.”

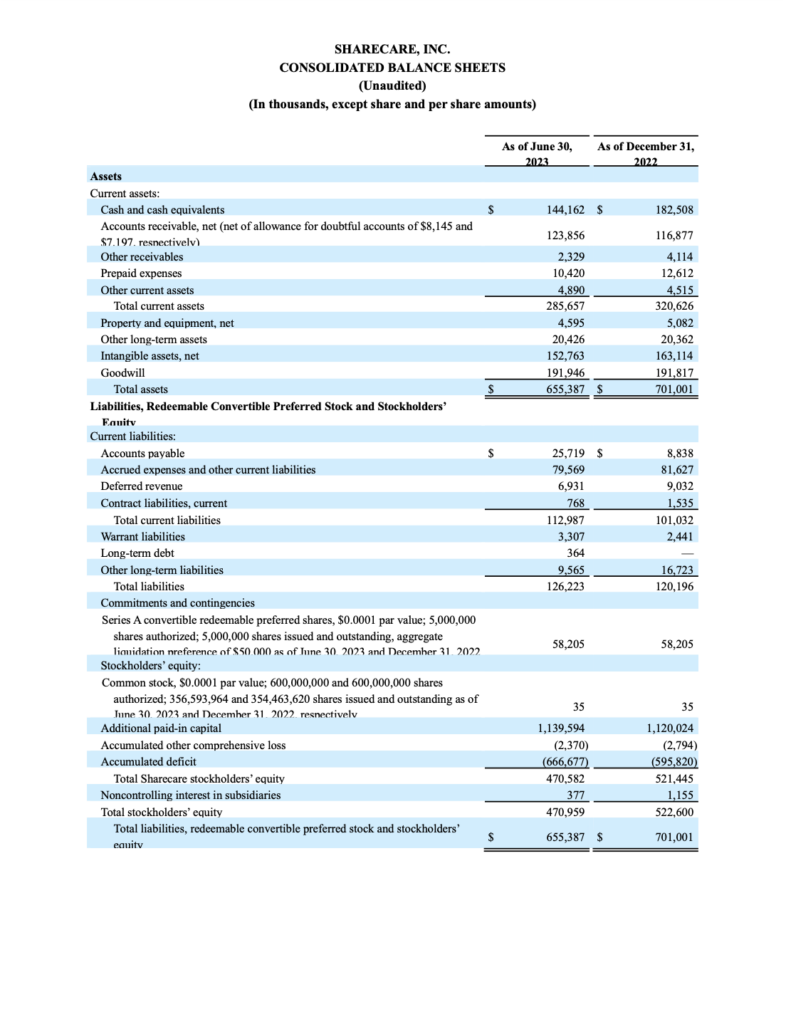

“Sharecare’s financial health remains strong, and we are pleased with our performance in the second quarter, expanding adjusted EBITDA margins, substantially improved cash burn, and the robustness of our balance sheet – all of which will help us reach our goal of cash flow breakeven by year’s end,” said Justin Ferrero, president and chief financial officer of Sharecare.

Financial Outlook

Third Quarter 2023 Financial Guidance

For the three months ending September 30, 2023, the Company expects:

- Revenue in the range of $111 million to $113 million

- Adjusted EBITDA in the range of $8 million to $10 million

Fiscal 2023 Financial Guidance

For the twelve months ending December 31, 2023, the Company continues to expect:

- Revenue in the range of $452.5 million to $460 million

- Adjusted EBITDA in the range of $25 million to $30 million

Ferrero added, “While our business will continue to have some channel-level seasonality going forward, our expected adjusted EBITDA in the third quarter is indicative of the emerging underlying earnings power of Sharecare, driven in part by our $30 million annualized cost-savings initiative, which we also are on track to achieve by the end of 2023.”

Conference Call

The Company will host a conference call to review the second quarter results today, Wednesday, August 9, 2023, at 8:00 a.m. EDT. The call can be accessed by dialing (833) 636-1352 for U.S. participants or (412) 902-4148 for international participants, and referencing the Sharecare earnings call; or via live audio webcast, available online at https://investors.sharecare.com/. A webcast replay of the call will be available for on-demand listening at the same link and will remain available for approximately 90 days.

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with U.S. GAAP, we believe the non-GAAP measures adjusted EBITDA, adjusted net loss, and adjusted loss per share are useful in evaluating our operating performance. We use adjusted EBITDA, adjusted net loss, and adjusted loss per share to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. In particular, we believe that the use of these non-GAAP measures is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures.

The calculations and reconciliations of historic adjusted EBITDA, adjusted net loss, and adjusted loss per share to net loss, the most directly comparable financial measure stated in accordance with GAAP, are provided below and in the accompanying financial tables. Investors are encouraged to review the reconciliations and not to rely on any single financial measure to evaluate our business.

We have not reconciled adjusted EBITDA guidance to net loss because we do not provide guidance for net loss or for items that we do not consider indicative of our ongoing performance, including, but not limited to, the impact of significant non-recurring items, as certain of these items are out of our control and/or cannot be reasonably predicted. Accordingly, reconciliations of adjusted EBITDA guidance to the corresponding U.S. GAAP measures are not available without unreasonable effort.

Adjusted EBITDA

We calculate adjusted EBITDA as net loss adjusted to exclude (i) depreciation and amortization, (ii) interest income, (iii) interest expense, (iv) income tax expense, (v) other income (expense) (non-operating), (vi) share-based compensation, (vii) warrants issued with revenue contracts, (viii) amortization of non-cash payment for research and development, (ix) net costs associated with exiting a contract, (x) non-operating, non-recurring costs, (xi) reorganizational and severance costs, and (xii) acquisition-related costs. We do not view the items excluded as representative of normal, recurring, cash operating expenses necessary to operate the Company’s lines of business and services.

Adjusted Net Loss

We calculate adjusted net loss as net loss attributable to Sharecare, Inc. adjusted to exclude (i) amortization of acquired intangibles, (ii) amortization of deferred financing fees, (iii) change in fair value of warrant liability and contingent consideration, (iv) share-based compensation, (v) warrants issued with revenue contracts, (vi) amortization of non-cash payment for research and development, (vii) net costs associated with exiting a contract, (viii) non-operating, non-recurring costs, (ix) reorganizational and severance costs, and (x) acquisition related costs. We do not view the items excluded as representative of normal, recurring, cash operating expenses necessary to operate the Company’s lines of business and services.

Adjusted Loss Per Share

We calculate adjusted lost per share as adjusted net loss, as defined above, divided by the number of weighted average common shares outstanding – basic and diluted.

About Sharecare

Sharecare is the leading digital health company that helps people – no matter where they are in their health journey – unify and manage all their health in one place. Our comprehensive and data-driven virtual health platform is designed to help people, providers, employers, health plans, government organizations, and communities optimize individual and population-wide well-being by driving positive behavior change. Driven by our philosophy that we are all together better, at Sharecare, we are committed to supporting each individual through the lens of their personal health and making high-quality care more accessible and affordable for everyone. To learn more, visit www.sharecare.com.

Important Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “outlook,” “target,” “reflect,” “on track,” “foresees,” “future,” “may,” “deliver,” “will,” “shall,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms, other comparable terminology (although not all forward-looking statements contain these words), or by discussions of strategy, plans, or intentions. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain.

Forward-looking statements in this press release include, but are not limited to, statements regarding our long-term strategy and positioning, growth, globalization and other strategic cost optimization initiatives and the corresponding benefits, including long-term growth, margin improvement and cash flow improvements, and partnerships or other relationships with third parties or customers, in each case on our future growth objectives and statements regarding our future results and outlook, including those under the caption “Financial Outlook.”

We cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward-looking statements are subject to a number of significant risks and uncertainties that could cause actual results to differ materially from expected results. For example, the Company’s Financial Outlook assumes business currently under contract and satisfaction by our customers of their contractual obligations under those agreements, which is not within the Company’s control. If a customer fails to satisfy its contractual obligations, actual revenue and Adjusted EBITDA could be negatively impacted. Descriptions of some of the other factors that could cause actual results to differ materially from these forward-looking statements are discussed in more detail in our filings with the U.S. Securities and Exchange Commission (the “SEC”), including the Risk Factors section of the Company’s Annual Report on Form 10-K filed with the SEC on March 30, 2023. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

Media Relations: Jen Martin Hall, jen@sharecare.com

Investor Relations: Bob East, SharecareIR@westwicke.com