Sharecare announces second quarter 2021 financial results and operational highlights

Updates FY 2021 revenue outlook to range of $414 million to $415 million from $408 million following the acquisition of CareLinx, a tech-enabled home health company

ATLANTA – Aug. 11, 2021 – Sharecare (Nasdaq: SHCR), the digital health company that helps people manage all their health in one place, today announced financial results for the quarter ended June 30, 2021.

“The second quarter reflects strong financial performance across our entire business and provides a solid foundation for accelerated growth as we enter the second half of the year,” said Jeff Arnold, founder, chairman, and chief executive officer of Sharecare. “Our commitment to delivering profitable, organic growth, combined with over $400 million of cash raised from our recent business combination, enables us to invest in innovation and new strategic opportunities like the acquisition of CareLinx to deliver added value to our customers while enhancing our growth.”

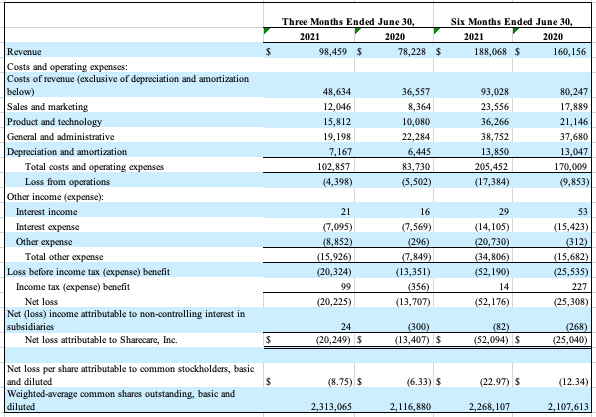

Second Quarter 2021 Financial Results

All comparisons, unless otherwise noted, are to the three months ended June 30, 2020.

- Revenue of $98.5 million compared to $78.2 million, an increase of 26% and coming in at the high end of guidance

- The acquisition of doc.ai contributed $5.0 million to revenue in the quarter

- Net loss of $20.2 million compared to net loss of $13.7 million

- Includes non-cash expenses of $8.9 million for the change in the fair value of warrant liabilities, anti-dilution provisions and other contingent consideration, including $2.6 million as a result of the doc.ai anti-dilution provision

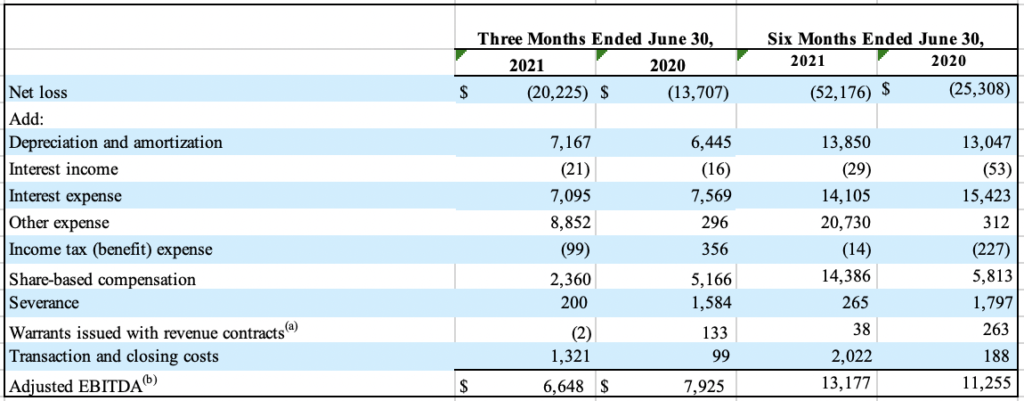

- Adjusted EBITDA of $6.6 million compared to $7.9 million, exceeding the guidance of $6.5 million, reflecting additional growth investments to support product innovation and expanded sales initiatives. Comparability with Adjusted EBITDA in Q2 2020 was impacted by temporary cost reductions as a result of furloughed employees, as well as salary and travel reductions due to COVID-19.

Second Quarter 2021 Operational Highlights

- Closed $50 million investment from second largest health plan in U.S. to co-develop next generation multi-payor advocacy solution as an extension to the Sharecare digital platform

- Added new employer, government, provider, and life sciences customers

- Launched several new government-sponsored health plans including Centene’s Peach State Health Plan Medicaid line of business and Humana’s CarePlus and their Medicare Advantage population

- Won Health Net’s Medicare line of business for both California and Oregon, which we believe represents an opportunity to add an estimated 800,000 new members

Financial Outlook

“By executing across all three of our channels – enterprise, provider, and consumer solutions – we organically grew total year-over-year revenue in the second quarter by approximately 20% while positive Adjusted EBITDA was ahead of our previous guidance,” said Justin Ferrero, president and chief financial officer of Sharecare. “We’ve established a solid foundation and are in a strong position to invest in new opportunities to further accelerate our growth and profitability, and with 97% of our business booked, we remain confident in our full year outlook.”

As announced today, Sharecare closed the acquisition of CareLinx, a nationwide home care platform that delivers intermittent on-demand personal care services in the homes of patients, while facilitating rich data capture, population health analytics, and real-time care coordination with remote clinical teams. Positioned to serve patient needs across the entire care continuum – from personal care to clinical care in the home – this acquisition brings a human touch to Sharecare’s digital solution with CareLinx’s network of more than 450,000 caregivers. Read more in the official press release.

Third Quarter 2021 Financial Guidance

For the three months ending September 30, 2021, the Company expects:

- Revenue in the range of $103 to $105 million, including approximately a $2 million contribution from CareLinx, representing greater than 28% growth over Q3 2020

- Adjusted EBITDA in the range of approximately $6 to $7 million, which includes significant continued investment in sales and innovation. The Adjusted EBITDA target also includes $1 million loss in the quarter from the CareLinx acquisition.

FY 2021 Financial Guidance

For the twelve months ending December 31, 2021, the Company is updating its outlook to reflect the impact of the CareLinx acquisition and now expects:

- Revenue in the range of $414 to $415 million, from approximately $408 million

- Adjusted EBITDA in the range of $28 to $30 million, from approximately $31 million. The $2 to $3 million Adjusted EBITDA reduction is related to the CareLinx acquisition.

Conference Call

The Company will host a conference call to review the second quarter results today, Wednesday, August 11, 2021, at 8:00 a.m. E.T. The call can be accessed by dialing (844) 284-3435 for U.S. participants, or (914) 800-3939 for international participants, and referencing the conference ID #8885479; or via live audio webcast, available online at https://investors.sharecare.com/. A webcast replay of the call will be available for on-demand listening at the same link and will remain available for approximately 90 days.

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with U.S. GAAP, we believe Adjusted EBITDA, a non-GAAP measure, is useful in evaluating our operating performance. We use Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. In particular, we believe that the use of Adjusted EBITDA is helpful to our investors as it is a metric used by management in assessing the health of our business and our operating performance. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measure as a tool for comparison.

The calculation and reconciliation of historic Adjusted EBITDA to net income (loss), the most directly comparable financial measures stated in accordance with GAAP, is provided below and in the accompanying financial tables. Investors are encouraged to review the reconciliation and not to rely on any single financial measure to evaluate our business.

We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative of our on-going performance, including, but not limited to, the impact of significant non-recurring items, as certain of these items are out of our control and/or cannot be reasonably predicted. Accordingly, a reconciliation of the Adjusted EBITDA guidance to the corresponding U.S. GAAP measure is not available without unreasonable effort.

Adjusted EBITDA

We calculate Adjusted EBITDA as net income (loss) adjusted to exclude (i) depreciation and amortization, (ii) interest income, (iii) interest expense, (iv) other expense (non-operating), (v) gain/loss from equity method investment, (vi) income tax (benefit) expense, (vii) share-based compensation, (viii) severance, (ix) warrant value for revenue contracts (x) common stock issues for services and (xi) transaction and closing costs. We do not view the items excluded as representative of our ongoing operations.

About Sharecare

Sharecare is the leading digital health company that helps people – no matter where they are in their health journey – unify and manage all their health in one place. Our comprehensive and data-driven virtual health platform is designed to help people, providers, employers, health plans, government organizations, and communities optimize individual and population-wide well-being by driving positive behavior change. Driven by our philosophy that we are all together better, at Sharecare, we are committed to supporting each individual through the lens of their personal health and making high-quality care more accessible and affordable for everyone. To learn more, visit www.sharecare.com.

Important Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “outlook,” “target,” “reflect,” “on track,” “foresees,” “future,” “may,” “deliver,” “will,” “shall,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms, other comparable terminology (although not all forward-looking statements contain these words), or by discussions of strategy, plans, or intentions. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we caution you that these statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain.

Forward-looking statements in this press release include, but are not limited to, our ability to realize the benefits of recent and future acquisitions, including CareLinx, partnerships or other relationships with third parties or customers, and the statements under the caption “Financial Outlook.” We cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward-looking statements are subject to a number of significant risks and uncertainties that could cause actual results to differ materially from expected results. Descriptions of some of the factors that could cause actual results to defer materially from these forward-looking statements are discussed in more detail in our filings with the SEC, including the Risk Factors section of the prospectus for our business combination filed with the SEC on June 3, 2021. Furthermore, if the forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

Media Relations:

Jen Martin Hall

Investor Relations:

Bob East

443-450-4189

SHARECARE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS*

(Unaudited)

(In thousands, except share and per share amounts)

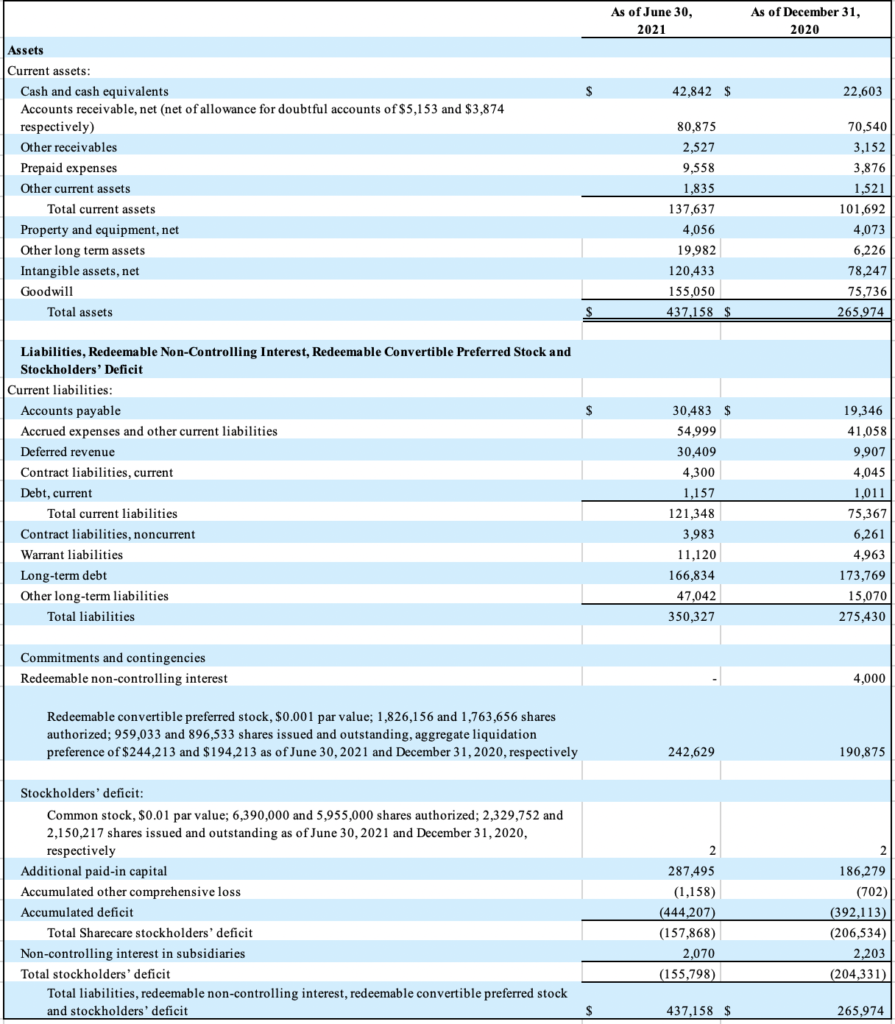

SHARECARE, INC.

CONSOLIDATED BALANCE SHEETS*

(Unaudited)

(In thousands, except share and per share amounts)

SHARECARE, INC.

RECONCILIATION OF GAAP NET LOSS TO ADJUSTED EBITDA

(Unaudited)

(In thousands)

*Includes minor correction of scriveners’ errors in original version.